While the broader market has struggled with the S&P 500 down 1.7% since September 2024, Custom Truck One Source has surged ahead as its stock price has climbed by 32.8% to $5.10 per share. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is there a buying opportunity in Custom Truck One Source, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Despite the momentum, we're sitting this one out for now. Here are three reasons why CTOS doesn't excite us and a stock we'd rather own.

Why Is Custom Truck One Source Not Exciting?

Inspired by a family gas station, Custom Truck One Source (NYSE:CTOS) is a distributor of trucks and heavy equipment.

1. Lackluster Revenue Growth

We at StockStory place the most emphasis on long-term growth, but within industrials, a stretched historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Custom Truck One Source’s recent history shows its demand has slowed significantly as its annualized revenue growth of 7% over the last two years was well below its five-year trend.

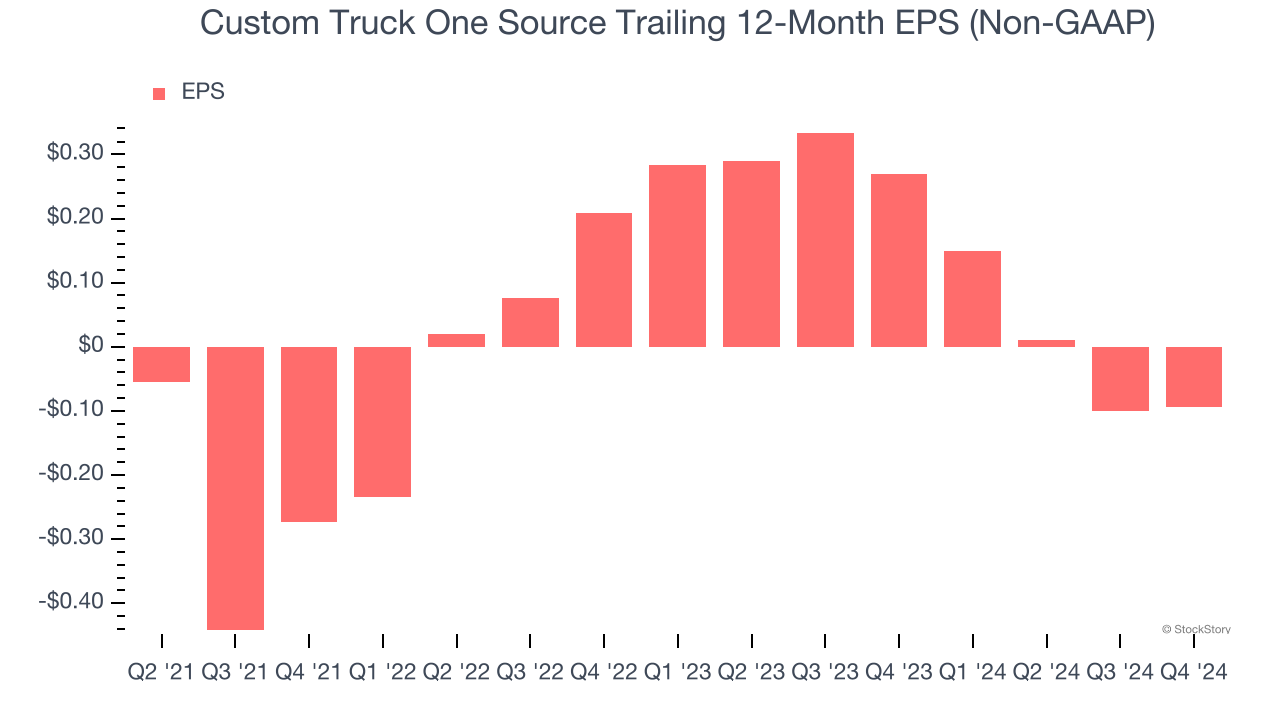

2. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Custom Truck One Source’s full-year EPS turned negative over the last four years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Custom Truck One Source’s low margin of safety could leave its stock price susceptible to large downswings.

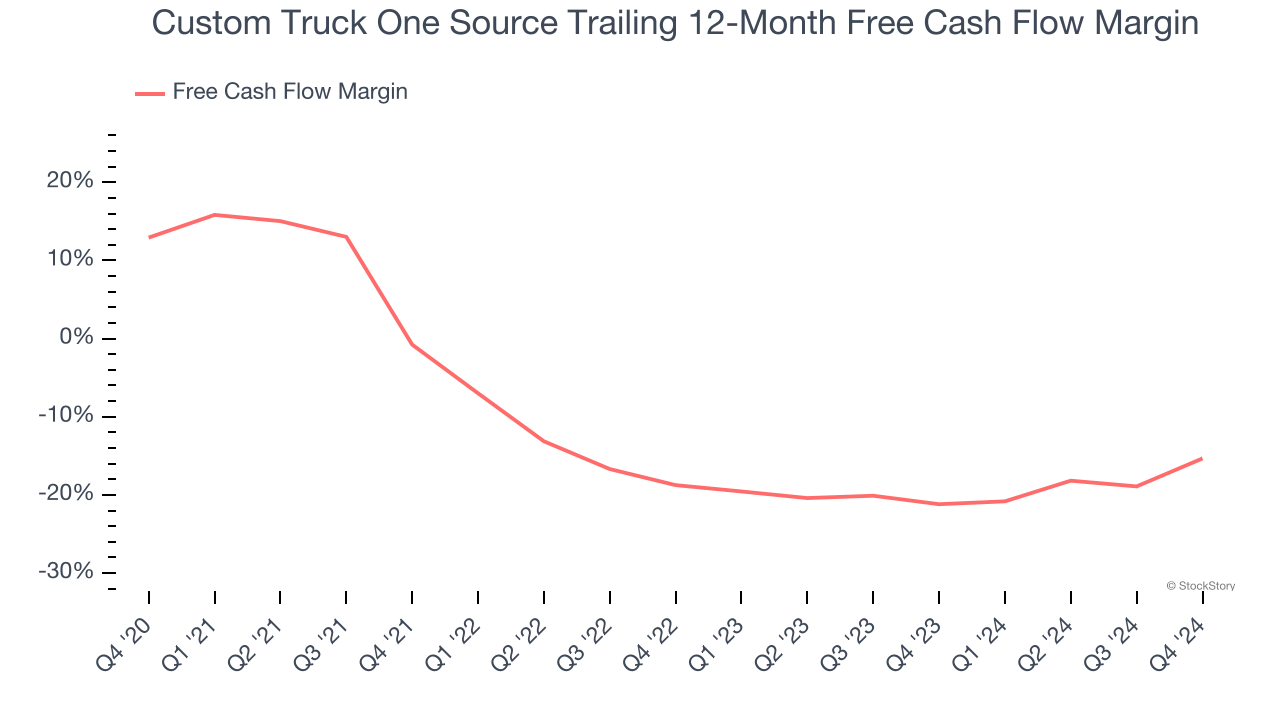

3. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Custom Truck One Source’s margin dropped by 28.3 percentage points over the last five years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. Almost any movement in the wrong direction is undesirable because it’s already burning cash. If the longer-term trend returns, it could signal it’s becoming a more capital-intensive business. Custom Truck One Source’s free cash flow margin for the trailing 12 months was negative 15.3%.

Final Judgment

Custom Truck One Source isn’t a terrible business, but it isn’t one of our picks. With its shares topping the market in recent months, the stock trades at 100.5× forward price-to-earnings (or $5.10 per share). This multiple tells us a lot of good news is priced in - we think there are better investment opportunities out there. We’d recommend looking at one of Charlie Munger’s all-time favorite businesses.

Stocks We Would Buy Instead of Custom Truck One Source

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.