News

Bloom Energy stock has grown almost 600% since last March. How much growth could this AI energy play have left?

Via The Motley Fool · March 5, 2026

On March 5, 2026, Veeva Systems Inc. (NYSE: VEEV) reminded the market why it remains the undisputed heavyweight of life sciences software. Following a blockbuster Q4 fiscal year 2026 earnings report and an optimistic forward guidance, the stock surged 11% in mid-day trading. This rally serves as a definitive "vote of confidence" for a company [...]

Via Finterra · March 5, 2026

As of March 5, 2026, Tesla, Inc. (NASDAQ: TSLA) finds itself at a historic inflection point. Long celebrated as the undisputed leader of the electric vehicle (EV) revolution, the company has spent the last 24 months navigating a "identity transition" that has polarized Wall Street. While the automotive industry globally is grappling with a cooling [...]

Via Finterra · March 5, 2026

As of today, March 5, 2026, the aviation sector is grappling with a sudden shift in macroeconomic tailwinds. American Airlines Group Inc. (NASDAQ: AAL) finds itself at the center of investor scrutiny following a significant analyst downgrade and a sharp spike in global oil prices. While the carrier celebrates its centennial year, the convergence of [...]

Via Finterra · March 5, 2026

As of March 5, 2026, Robinhood Markets, Inc. (NASDAQ: HOOD) has officially shed its reputation as a mere "meme stock" gateway, evolving into a diversified global financial powerhouse. Once defined by the volatility of the 2021 retail trading frenzy, Robinhood has spent the last two years executing a rigorous strategic pivot. Today, the company stands [...]

Via Finterra · March 5, 2026

The digital asset landscape witnessed a significant resurgence on March 5, 2026, as Bitcoin (BTC) reclaimed the $73,000 level, sparking a broad market rally. At the center of this optimism is Coinbase Global, Inc. (NASDAQ: COIN), which saw its shares surge 14.6% in a single session. Once viewed merely as a volatile retail brokerage, the [...]

Via Finterra · March 5, 2026

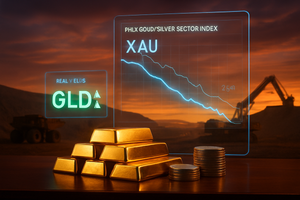

The precious metals sector has staged a remarkable rally in early March 2026, as the PHLX Gold/Silver Sector Index (XAU) tests historic highs amid a massive influx of institutional capital. Driven by a significant decline in inflation-adjusted "real" yields, investors have aggressively rotated into gold-backed assets, resulting in over

Via MarketMinute · March 5, 2026

On March 5, 2026, the retail sector witnessed a definitive signal of consumer resilience as Ross Stores, Inc. (NASDAQ: ROST) saw its stock price surge by over 8%, reaching a new 52-week high of $213.52. This rally followed a "blowout" fourth-quarter earnings report for the 2025 fiscal year, characterized by a significant beat on both [...]

Via Finterra · March 5, 2026

As the first quarter of 2026 unfolds, the gold mining sector has transformed from a traditional defensive harbor into a high-octane engine for portfolio growth. With spot gold prices surging toward the $6,300 per ounce mark, the industry’s heavyweights are witnessing a fundamental re-rating. Recent research notes from

Via MarketMinute · March 5, 2026

As of March 5, 2026, the global financial landscape is still reeling from the most significant constitutional and economic collision in decades. Following the February 20 decision by the U.S. Supreme Court to strike down President Trump’s sweeping "Liberation Day" tariffs, a vacuum of fiscal uncertainty has pulled

Via MarketMinute · March 5, 2026

Investors looking for hidden gems should keep an eye on small-cap stocks because they’re frequently overlooked by Wall Street. Many opportunities exist in th...

Via StockStory · March 5, 2026

NEW YORK — The silver market has long been nicknamed "gold on steroids," but the first week of March 2026 has pushed that reputation to its absolute limit. After a tumultuous start to the year that saw silver touch historic highs in January, the metal faced a brutal reckoning on Tuesday,

Via MarketMinute · March 5, 2026

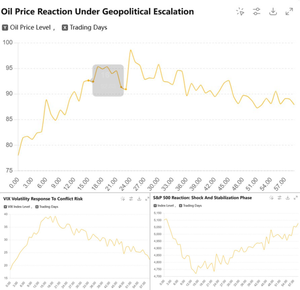

The global financial landscape has been thrown into a state of high-intensity volatility following the commencement of a massive, coordinated military campaign by the United States and Israel against Iranian strategic targets. As of today, March 5, 2026, the geopolitical landscape has shifted fundamentally, sending shockwaves through commodity pits and

Via MarketMinute · March 5, 2026

On this morning of March 5, 2026, The Kroger Co. (NYSE: KR) stands at a pivotal crossroads in its 143-year history. Following the release of its fourth-quarter and full-year 2025 financial results, the Cincinnati-based retail giant has signaled a definitive shift in strategy. After the high-profile collapse of its $24.6 billion merger with Albertsons Companies, [...]

Via Finterra · March 5, 2026

On this Thursday, March 5, 2026, the retail world has its eyes fixed on Issaquah, Washington. Costco Wholesale Corp. (NASDAQ: COST) is set to release its second-quarter fiscal 2026 earnings after the market close, a report that arrives at a critical juncture for the global retail giant. Amidst a macro environment defined by "sticky" inflation [...]

Via Finterra · March 5, 2026

BTCPressWire was founded by PR veterans, so we understand your pain points and know how to address them.

Via GlobePRwire · March 5, 2026

How Can a Financial Advisor Help Plan For Retirement And Legacy Planning?

Retirement planning is not just about saving a certain amount of money. It is about turning what you saved into income you can trust for decades. Legacy planning adds questions about family, values, and what you want your assets to accomplish after you are gone. A financial advisor helps connect these goals into a single plan that is easier to follow. That guidance can reduce stress when markets shift or when life changes fast. It also creates a repeatable process for reviewing decisions before small mistakes get expensive.

Via GlobePRwire · March 5, 2026

I used to be convinced that I'd claim Social Security at 62 -- but two big factors changed my opinion.

Via The Motley Fool · March 5, 2026

Iran paying for crimes in blood as U.S.-Israel campaign continues. Betters predict no quick ceasefire. Energy crisis with oil prices rising. Trump may need resolution fast to avoid inflation and rate cuts.

Via Benzinga · March 5, 2026

Journalist and crypto commentator Paul Barron argues Ripple (CRYPTO: XRP) is next in line for Federal Reserve master account access after Krak

Via Benzinga · March 5, 2026

Carrying a $5,000 credit card balance can quietly cost you over $1,000 a year. Here's the math and how to stop it.

Via The Motley Fool · March 5, 2026

Robinhood Markets Inc. shares are trading higher Thursday after launching its Platinum credit card and custodial accounts in a new family hub.

Via Benzinga · March 5, 2026

Bitcoin's volatility is impacting the trading platform.

Via The Motley Fool · March 5, 2026

(BPT) - Sponsored by the Southwest Rapid Rewards® Credit Cards from Chase

Via Brandpoint · March 5, 2026

London, United Kingdom - Global financial markets have entered a highly sensitive state surrounding the escalation of US and Israeli

Via First Publisher · March 5, 2026