Latest News

The iShares Ethereum Trust ETF provides regulated exposure to ether’s price performance for institutional and retail investors alike.

Via The Motley Fool · February 3, 2026

Debunking rumors and providing the facts as reported regarding the Tesla, XAI, SpaceX investment, merger, or other.

Via Talk Markets · February 3, 2026

Fresh disclosures showed $429 million raised by Trump allies, with crypto firms emerging as major political donors.

Via Stocktwits · February 3, 2026

This thriving fintech stock is taking a double-digit dip in 2026.

Via The Motley Fool · February 3, 2026

MPLX LP (NYSE:MPLX) Q4 2025 Earnings Beat Analyst Estimateschartmill.com

Via Chartmill · February 3, 2026

SOUTHSTATE BANK CORP (NYSE:SSB) Presents a High-Growth and Technically Sound Investment Opportunitychartmill.com

Via Chartmill · February 3, 2026

Merck & Co. Inc. (NYSE:MRK) Beats Q4 Estimates but 2026 Outlook Cautions Investorschartmill.com

Via Chartmill · February 3, 2026

RPC INC (NYSE:RES) Reports Mixed Q4 2025 Results, Misses EPS Estimateschartmill.com

Via Chartmill · February 3, 2026

Merck, PepsiCo, and Eaton Corporation have unveiled their earnings for the fourth quarter of 2025, showcasing their performance against market expectations.

Via Talk Markets · February 3, 2026

BALL CORP (NYSE:BALL) Meets Q4 2025 Earnings Estimates, Sees Pre-Market Gainschartmill.com

Via Chartmill · February 3, 2026

Pfizer Inc. (NYSE:PFE) Beats Q4 2025 Estimates but Muted Outlook Tempers Investor Reactionchartmill.com

Via Chartmill · February 3, 2026

GRAPHIC PACKAGING HOLDING CO (NYSE:GPK) Shares Drop on Q4 2025 Earnings Miss Despite Revenue Beatchartmill.com

Via Chartmill · February 3, 2026

Patria Investments (NASDAQ:PAX) Reports Strong Fee Growth and Record Fundraising Despite Revenue Misschartmill.com

Via Chartmill · February 3, 2026

SoFi has significant excess capital and ambitious plans to expand its product portfolio.

Via The Motley Fool · February 3, 2026

Gartner Inc (NYSE:IT) Stock Falls 6% Pre-Market After Q4 2025 Revenue Misschartmill.com

Via Chartmill · February 3, 2026

Atkore Inc (NYSE:ATKR) Reports Mixed Q1 2026 Results with Earnings Beat and Revenue Misschartmill.com

Via Chartmill · February 3, 2026

ARCHER-DANIELS-MIDLAND CO (NYSE:ADM) Reports Q4 Earnings Beat Amid Revenue Miss and Cautious 2026 Outlookchartmill.com

Via Chartmill · February 3, 2026

Rithm Capital Corp (NYSE:RITM) Reports Strong Q4 2025 Earnings Beatchartmill.com

Via Chartmill · February 3, 2026

Marathon Petroleum Corp (NYSE:MPC) Shares Surge on Strong Q4 Earnings Beatchartmill.com

Via Chartmill · February 3, 2026

UniFirst provides workplace uniforms and facility services via recurring contracts to a broad customer base in North America and beyond.

Via The Motley Fool · February 3, 2026

Pentair PLC (NYSE:PNR) Beats Q4 Estimates and Raises Dividend Amid Mixed Segment Resultschartmill.com

Via Chartmill · February 3, 2026

Enterprise Products Partners (NYSE:EPD) Reports Q4 2025 Earnings Beat on Record Volumeschartmill.com

Via Chartmill · February 3, 2026

PJT Partners Inc. (NYSE:PJT) Reports Record 2025 Revenue and Earnings Beatchartmill.com

Via Chartmill · February 3, 2026

Capri Holdings Ltd (NYSE:CPRI) Beats Q3 Earnings Expectations in First Post-Versace Reportchartmill.com

Via Chartmill · February 3, 2026

Eaton Corp PLC (NYSE:ETN) Reports Record 2025 Results Despite Q4 Revenue Misschartmill.com

Via Chartmill · February 3, 2026

Zimmer Biomet Holdings Inc (NYSE:ZBH): A Durable Dividend Cornerstone for Income Investorschartmill.com

Via Chartmill · February 3, 2026

PYPL Stock Declines Pre-Market After Q4 Earnings Miss: PayPal Appoints New CEOstocktwits.com

Via Stocktwits · February 3, 2026

Ingredion Inc. (NYSE:INGR) Reports Record Annual EPS but Q4 Revenue Miss, Shares Dropchartmill.com

Via Chartmill · February 3, 2026

The 4 Safest Places to Keep Your Cash in 2026fool.com

Via The Motley Fool · February 3, 2026

The Pound Sterling trades cautiously ahead of the BoE policy announcement on Thursday.

Via Talk Markets · February 3, 2026

The AI race is still thriving in 2026.

Via The Motley Fool · February 3, 2026

Autoliv develops advanced safety systems for global automakers, supplying airbags, seatbelts, and related technologies worldwide.

Via The Motley Fool · February 3, 2026

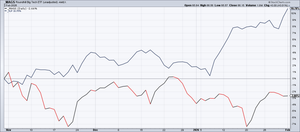

The market closed with an elongated price structure, recovering much of the previous week’s decline with strong bullish momentum.

Via Talk Markets · February 3, 2026

High-volatility cryptocurrencies with explosive upside potential should get the biggest boost from prediction markets.

Via The Motley Fool · February 3, 2026

Dan Ives Sees Possibility Of Tesla Eventually Getting Merged With SpaceX And xAIstocktwits.com

Via Stocktwits · February 3, 2026

Futu Holdings Ltd-ADR (NASDAQ:FUTU) Screens as a Strong CAN SLIM Candidatechartmill.com

Via Chartmill · February 3, 2026

Globus Medical Inc - A (NYSE:GMED) Shows Strong Fundamentals and Technical Setup for Growthchartmill.com

Via Chartmill · February 3, 2026

Asian markets bounced back strongly after experiencing their steepest decline in over two months.

Via Talk Markets · February 3, 2026

The metal market looked to erase some gains from the recent sell-off as Gold aims for the $5k area.

Via Talk Markets · February 3, 2026

Via MarketBeat · February 3, 2026

According to JPMorgan, about 65% of global family offices are prioritizing artificial intelligence investments over cryptocurrencies.

Via Stocktwits · February 3, 2026

Why pay more for Medicare than you have to?

Via The Motley Fool · February 3, 2026

GXO LOGISTICS INC (NYSE:GXO) Shows Strong Technical Setup for Potential Breakoutchartmill.com

Via Chartmill · February 3, 2026

Pan American Silver Corp (NYSE:PAAS) Fits the 'Growth at a Reasonable Price' Modelchartmill.com

Via Chartmill · February 3, 2026

Why Is MAMO Stock Falling Pre-Market Today?stocktwits.com

Via Stocktwits · February 3, 2026

Verizon is going on the offensive, which should be good for the stock.

Via The Motley Fool · February 3, 2026

There is something interesting happening beneath the surface in the market right now.

Via Talk Markets · February 3, 2026

So much of what we believe we "should" do is a figment of our imaginations.

Via The Motley Fool · February 3, 2026

Bitcoin ETFs Kick Off February With $560 Million Inflows After $1.5 Billion Selloffstocktwits.com

Via Stocktwits · February 3, 2026

One day late on a credit card payment usually won't hurt your credit, but it can still trigger fees and interest. Here's what happens.

Via The Motley Fool · February 3, 2026