Let’s dig into the relative performance of Biogen (NASDAQ:BIIB) and its peers as we unravel the now-completed Q4 therapeutics earnings season.

Over the next few years, therapeutic companies, which develop a wide variety of treatments for diseases and disorders, face strong tailwinds from advancements in precision medicine (including the use of AI to improve hit rates) and growing demand for treatments targeting rare diseases. However, headwinds such as rising scrutiny over drug pricing, regulatory unknowns, and competition from larger, more resourced pharmaceutical companies could weigh on growth.

The 10 therapeutics stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 2.6%.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

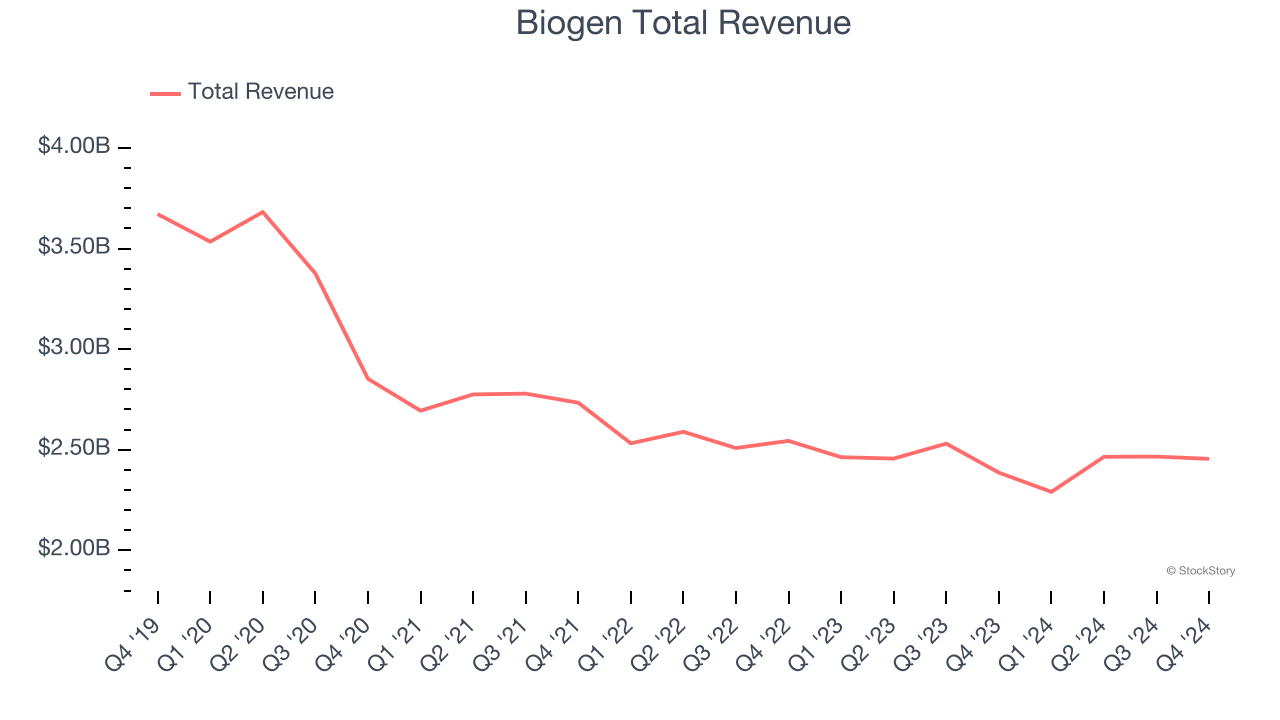

Biogen (NASDAQ:BIIB)

Founded in 1978 and pioneering treatments for some of medicine's most complex challenges, Biogen (NASDAQ:BIIB) develops and markets therapies for neurological conditions, including multiple sclerosis, Alzheimer's disease, spinal muscular atrophy, and rare diseases.

Biogen reported revenues of $2.45 billion, up 2.9% year on year. This print exceeded analysts’ expectations by 1.8%. Despite the top-line beat, it was still a slower quarter for the company with a significant miss of analysts’ full-year EPS guidance estimates.

The stock is up 1.8% since reporting and currently trades at $141.86.

Read our full report on Biogen here, it’s free.

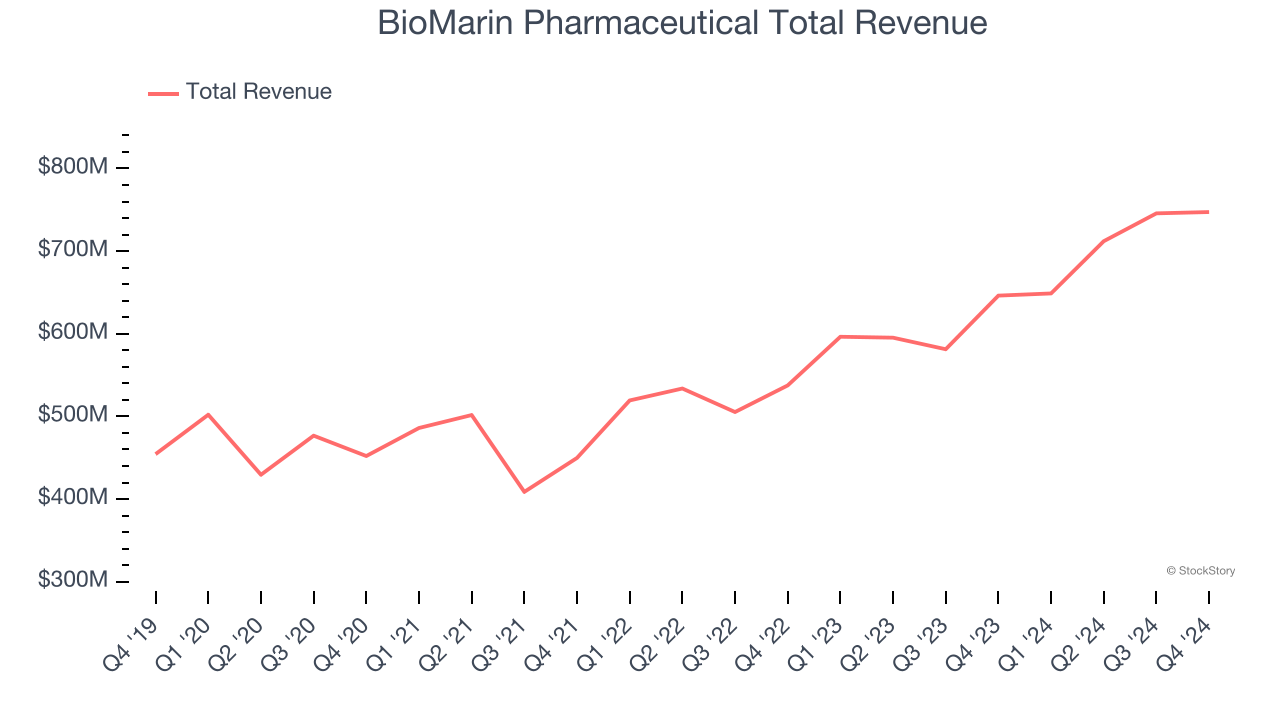

Best Q4: BioMarin Pharmaceutical (NASDAQ:BMRN)

Pioneering treatments for conditions that often had no previous therapeutic options, BioMarin Pharmaceutical (NASDAQ:BMRN) develops and commercializes therapies that address the root causes of rare genetic disorders, particularly those affecting children.

BioMarin Pharmaceutical reported revenues of $747.3 million, up 15.6% year on year, outperforming analysts’ expectations by 4.8%. The business had a stunning quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ full-year EPS guidance estimates.

BioMarin Pharmaceutical pulled off the highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 10.1% since reporting. It currently trades at $72.31.

Is now the time to buy BioMarin Pharmaceutical? Access our full analysis of the earnings results here, it’s free.

Slowest Q4: Moderna (NASDAQ:MRNA)

Rising to global prominence during the COVID-19 pandemic with one of the first effective vaccines, Moderna (NASDAQ:MRNA) develops messenger RNA (mRNA) medicines that direct the body's cells to produce proteins with therapeutic or preventive benefits for various diseases.

Moderna reported revenues of $966 million, down 65.6% year on year, in line with analysts’ expectations. It was a slower quarter as it posted full-year revenue guidance missing analysts’ expectations.

Moderna delivered the slowest revenue growth and weakest full-year guidance update in the group. Interestingly, the stock is up 4.4% since the results and currently trades at $33.37.

Read our full analysis of Moderna’s results here.

Vertex Pharmaceuticals (NASDAQ:VRTX)

Founded in 1989 with a mission to create medicines that treat the underlying causes of disease rather than just symptoms, Vertex Pharmaceuticals (NASDAQ:VRTX) develops and markets transformative medicines for serious diseases, with a focus on cystic fibrosis, sickle cell disease, and pain management.

Vertex Pharmaceuticals reported revenues of $2.91 billion, up 15.7% year on year. This print surpassed analysts’ expectations by 4.9%. It was a strong quarter as it also produced full-year revenue guidance meeting analysts’ expectations.

The stock is up 8.9% since reporting and currently trades at $511.46.

Read our full, actionable report on Vertex Pharmaceuticals here, it’s free.

United Therapeutics (NASDAQ:UTHR)

Founded by a mother seeking treatment for her daughter's pulmonary arterial hypertension, United Therapeutics (NASDAQ:UTHR) develops and commercializes medications for chronic lung diseases and other life-threatening conditions, with a focus on pulmonary hypertension treatments.

United Therapeutics reported revenues of $735.9 million, up 19.7% year on year. This number met analysts’ expectations. More broadly, it was a slower quarter as it produced a slight miss of analysts’ EPS estimates.

The stock is down 10.4% since reporting and currently trades at $320.85.

Read our full, actionable report on United Therapeutics here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.